Balancing a budget

April 14, 2015

Learning how to budget money is a typical issue for many young people when they are no longer relying on their parents to pay for most of their expenses. However, the cost of living alone can be more expensive than thought.

To see what’s awaiting teenagers when they leave home, I was given the task of creating a budget based off earning minimum wage plus tips as a server at a chain restaurant and living in the Allen area. Servers are only paid $2.13 per hour, so they are dependent on tips which average $350 per week working full time, resulting in an income of approximately $1500 per month.

This experiment had me paying for everything myself while trying to save $100 a month. To afford a one bedroom apartment at The Lofts at Watters Creek in Allen I was going to have to get a roommate. Then, I had to settle with only using public transportation and riding a bike instead of paying for a car. I was also going to have to cut down on all of my activities that are not a necessity for living including Netflix, my gym membership, fashionable clothing and most other pleasures that cost money.

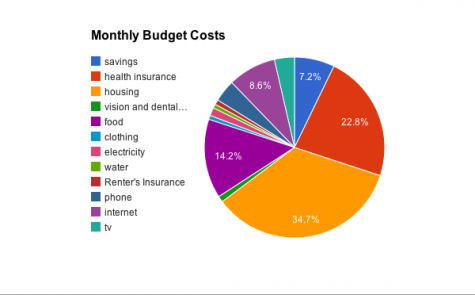

In fact, trying to live on my own working as a server would be almost impossible without the help of my parents if I wanted to keep up the same lifestyle that I have now. So where did my monthly income of $1500 go? The graphic below shows the financial breakdown of an average month of trying to live on your own in Allen.